THREE TYPES OF MARKET TRENDS

The price of an instrument will always move in one of three ways – upwards, downwards, or sideways. These 3 types of market trends are easy to recognise on a chart of historical price action. Although, tracking the market movements and recognising market trends as they unfold can be tricky!

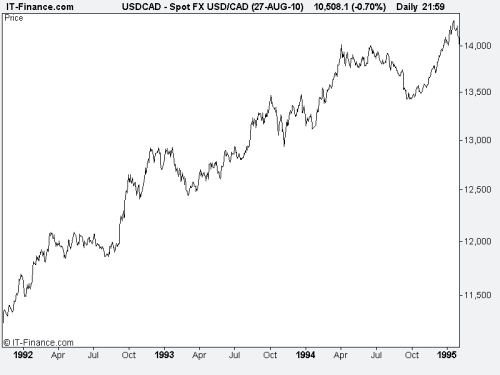

Uptrend Market Trend

In an uptrend, the market moves in a clear upward direction for a sustained period. Traders commonly call uptrend market the “bull market”.

Downtrend Market Trend

In a downtrend, the market moves in a clear downwards direction for a sustained period. This market trend is also known a the “bear market”.

Sideways Market Trend

A sideways ‘trend’ is when the market is not really trending at all. Instead, the market is moving sideways in a series of small up and down movements.

When price moves sideways, as in the last example above, this may also be referred to as a ‘trendless’, ‘ranging’, or ‘choppy’ market.

Even within a clearly defined up or down trend, there will always be short periods in which price moves briefly in the opposite direction. These periods are known as ‘retracements’, ‘consolidations’, or ‘back-filling’. They occur when the consensus of the market is to re-evaluate the trend, and they are often associated with profit-taking.

The price of an instrument will spend approximately 40% of its time in a trending state. The rest of the time, the market will spend in sideways movements.

3 Phases if Market Trends

• Accumulation – where market makers and institutional traders set up a market movement. Often with an enormous buy or sell order worth millions of dollars. Within the exchanges there exists an established pecking order in which different ‘locals’ (like Scalper C in our earlier example) participate in and aim to profit from the accumulation phase. Those lowest in the pecking order will be left with the difficult task of trying to ‘sell’ the move to the public.

• Public participation – when speculators start to spot an opportunity and a rapid and obvious price movement occurs as they get with the trend.

• Excess – the final stage of a market. Here the last members of the public jump aboard a sinking ship. The experts, on the other hand, take profits and exit with massive counter-orders that fire off a reversal.